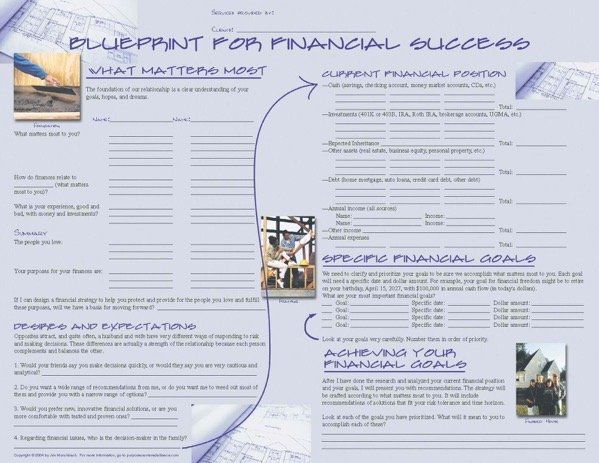

The Blueprint for Financial Advisors

The Blueprint for Financial Success: Empowering Financial Advisors to Create Compelling Financial Plans

The Blueprint for Financial Advisors – Framework

The Blueprint for Financial Success is not only a comprehensive guide for clients but also a powerful training tool for Financial Advisors. For those seeking to enhance their skills and help clients connect their resources to What Matters Most, this blueprint provides invaluable training.

Financial Advisors play a crucial role in guiding their clients towards financial clarity, and The Blueprint for Financial Success equips them with the necessary tools. By using this blueprint, Financial Advisors can learn how to assist clients in clarifying their vision, values, and purpose. Understanding these aspects allows Financial Advisors to create compelling financial plans that align with their clients’ core principles and objectives.

The Blueprint for Financial Success is the metaphor used in the book What Matters Most. Financial Advisors learn how to build a Purpose-Centered Alliance with clients by helping them connect their money to “What Matters Most“.

By understanding their clients’ unique aspirations, Financial Advisors can craft financial plans that reflect their clients’ deepest desires and long-term goals. This approach ensures that clients’ financial resources are utilized in a way that aligns with their vision, values, and purpose.

The blueprint enables Financial Advisors to go beyond mere numbers and transactions. It empowers them to engage in meaningful conversations with their clients, uncovering their clients’ motivations, dreams, and aspirations. By connecting with clients on a deeper level, Financial Advisors can create financial plans that not only address their clients’ financial needs but also contribute to their overall fulfillment and well-being.

Through The Blueprint for Financial Success, Financial Advisors gain insights into various strategies and techniques to help clients achieve financial clarity. The training covers areas such as goal setting, values-based planning, wealth preservation, and legacy building. Armed with these tools, Financial Advisors can guide their clients towards a financial plan that is both effective and deeply meaningful.

The Blueprint for Financial Success transforms Financial Advisors into trusted partners who support their clients in aligning their financial resources with their most cherished priorities. It goes beyond traditional financial planning by incorporating the clients’ vision, values, and purpose into the process. With this powerful training tool, Financial Advisors can make a profound impact on their clients’ lives and help them create a financial plan that truly reflects What Matters Most.

The Blueprint for Financial Success: An Overview

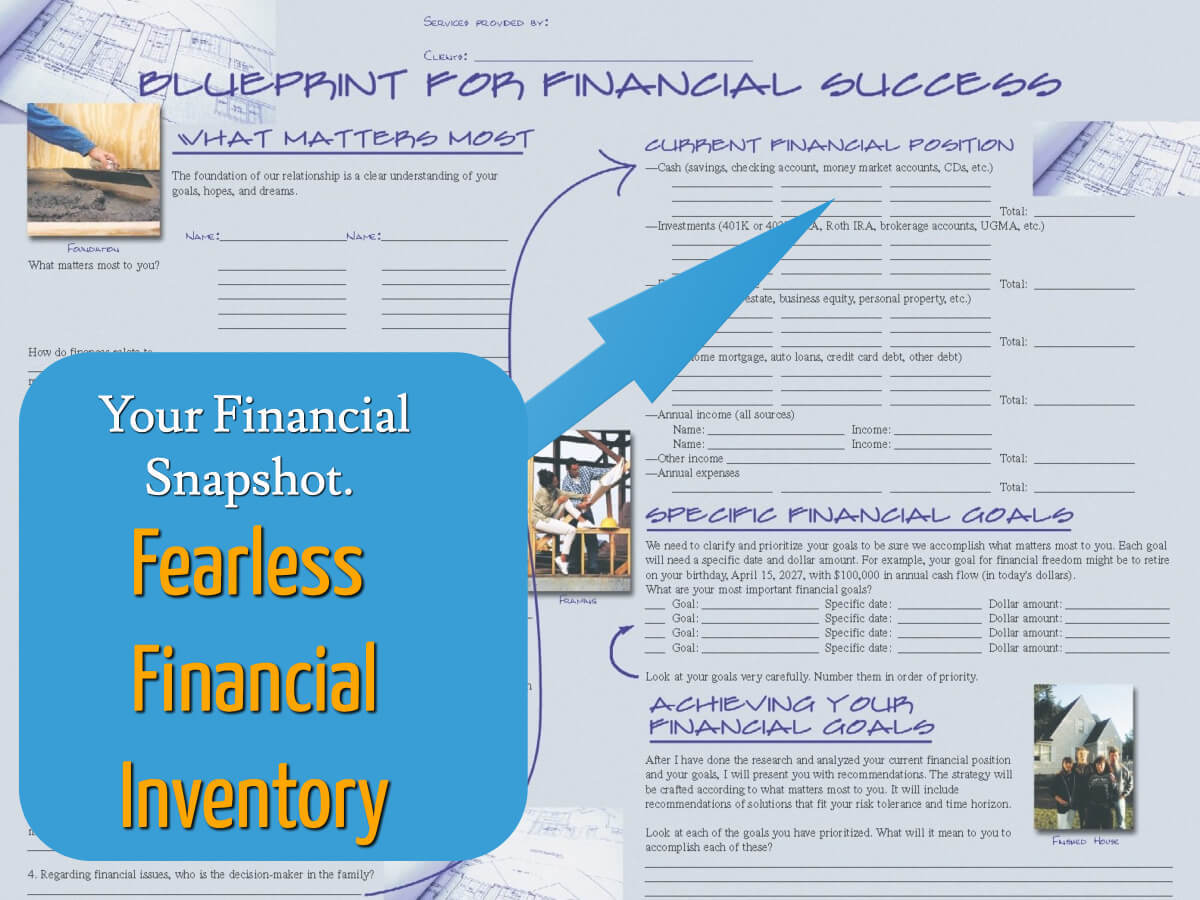

The Blueprint for Financial Success is a holistic framework that covers every aspect of the Financial Planning Process.

1. Financial Independence or Retirement Planning

One of the primary goals for many individuals is achieving financial independence or planning for a comfortable retirement.

The Blueprint for Financial Success guides you through the process of setting specific retirement goals, determining the required savings, and implementing strategies to maximize your retirement funds.

2. Risk Management or Insurance Planning

Protecting yourself, your family, and your assets against unforeseen events is a critical aspect of financial planning.

The blueprint emphasizes the importance of risk management and guides you in assessing your insurance needs. We help you understand different insurance policies, such as life insurance, health insurance, property insurance, and liability coverage. By evaluating your risks and identifying suitable insurance solutions, you can safeguard your financial well-being and achieve peace of mind.

3. Estate Planning

Planning for the distribution of your assets and the preservation of your legacy is vital for individuals and families alike.

The Blueprint for Financial Success highlights the significance of estate planning and provides guidance on wills, trusts, powers of attorney, and other essential estate planning tools. We help you navigate the complexities of estate taxation, asset protection, and the transfer of wealth, ensuring that your wishes are fulfilled and your loved ones are taken care of.

4. Education Planning

Investing in education is a significant financial goal for many families.

The blueprint offers strategies and insights to help you plan and save for your children’s education. We explore options such as 529 plans, Coverdell Education Savings Accounts, and other tax-advantaged savings vehicles. By incorporating education planning into your financial journey, you can provide your children with the best educational opportunities without compromising your long-term financial stability.

5. Tax Planning Strategies

Optimizing your tax liabilities is a key aspect of financial planning. The blueprint equips you with valuable tax planning strategies to minimize your tax burden legally.

We cover topics such as deductions, credits, tax-efficient investments, and retirement account contributions. By employing effective tax planning strategies, you can maximize your after-tax income, preserve more of your hard-earned money, and accelerate your progress towards your financial goals.

6. Investment Management Strategies

Building and managing a diversified investment portfolio is essential for long-term financial success.

The blueprint provides insights into various investment options, asset allocation strategies, and risk management techniques. We guide you through the investment selection process, taking into account your risk tolerance, time horizon, and financial objectives. With our investment management strategies, you can optimize your returns while mitigating risk.

7. Cash Flow Management

Effectively managing your cash flow is the foundation of sound financial planning.

The blueprint emphasizes the significance of budgeting, expense tracking, and debt management. We provide practical tips and tools to help you streamline your cash inflows and outflows, ensuring you have a healthy financial foundation. By mastering cash flow management, you can achieve financial discipline, reduce debt, and create opportunities for wealth accumulation.

More About The Blueprint for Financial Success

The Blueprint was created by Jim Munchbach, CFP® Professional as a tool to help individual investors, families, and business owners manage the risk and opportunity of everyday life, recover from the unexpected, and realize their highest purpose.

The Blueprint is for…

-

Individual Investors who want to build a better retirement plan

-

Families who want to equip the next generation

-

Financial Advisory teams who want to deliver Smarter Strategies and Better Results

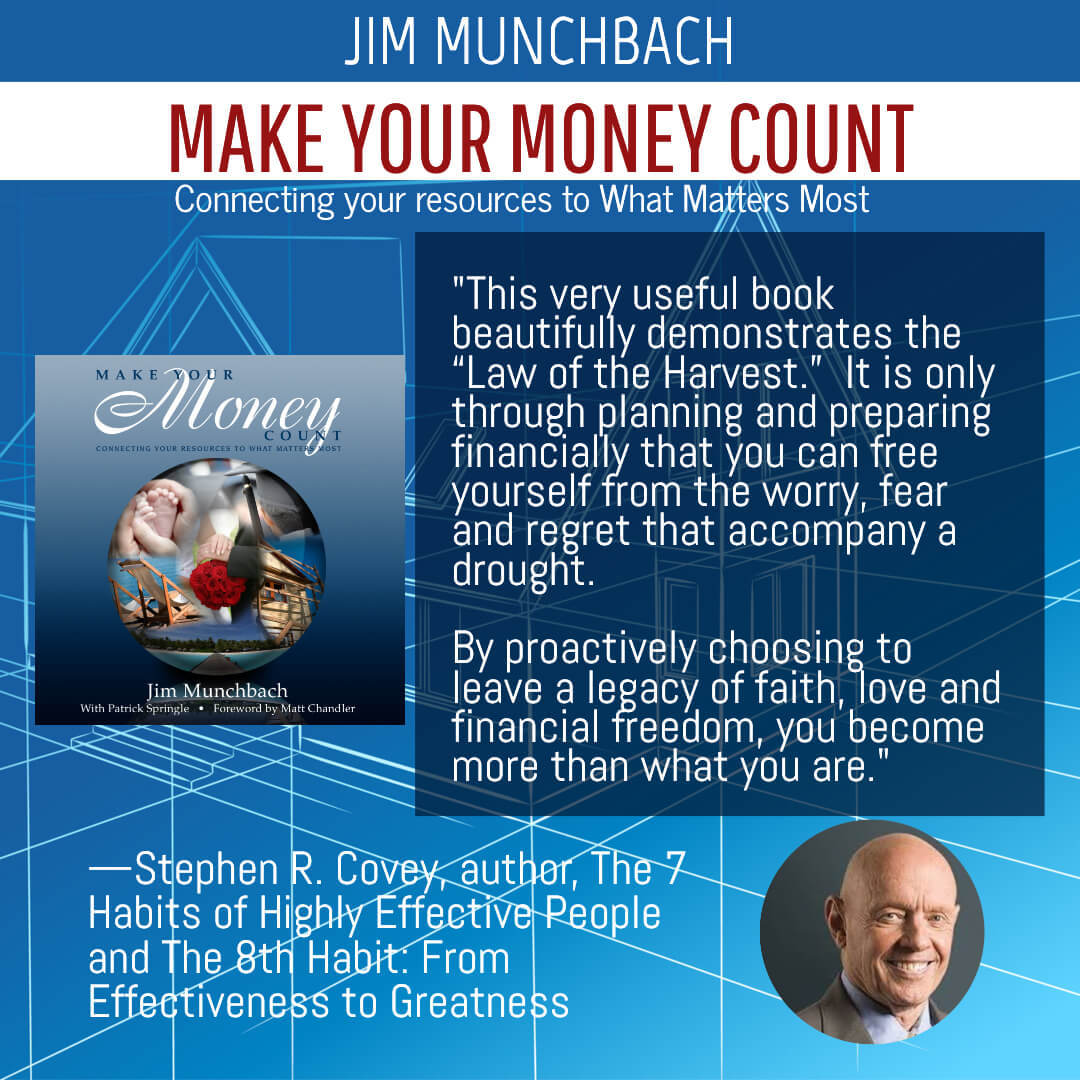

What others say about Make Your Money Count

This very useful book beautifully demonstrates the “Law of the Harvest.” It is only through planning and preparing financially that you can free yourself from the worry, fear and regret that accompany a drought. By proactively choosing to leave a legacy of faith, love and financial freedom, you become more than what you are.

—Stephen R. Covey, author, The 7 Habits of Highly Effective People and The 8th Habit: From Effectiveness to Greatness

“Jim has a gift. He can write about money and life in a way that will change how you manage both. Read him and watch God change your heart!”

— John Ortberg, Pastor – Menlo Park Presbyterian Church

“Make Your Money Count stands out from other guides on money management because it drives home an important truth: Clarifying your purpose in life is the essential element in financial planning. The book offers an excellent blueprint for success and provides easy-to-follow steps that will align your money with your best intentions and put your finances in divine order.”

—Ken Blanchard, co-author of The One Minute Manager® and Leading at a Higher Level

“Jim’s heart and values speak clearly as he integrates biblical principles into the 21st century opportunities and problems of managing money. He weaves practical points through magnetic stories, making it a must read for anyone who wants to finally get it right financially!”

—Judy Santos , Master Certified Coach, Founder and President – Christian Coaches Network Inc.

“As trusted advisors, we recognize that motivation is the key to change. In Make Your Money Count, Jim Munchbach provides powerful motivations to connect our finances with our purpose in life. This, I know, makes all the difference in the world. I enthusiastically recommend Jim’s book”

— Ron Blue , President, Christian Financial Professionals Network CFPN

“This book shows you how to get complete control over your money and your life, develop a financial plan and achieve complete independence.”

— Brian Tracy – Author – The Way To Wealth

“Make Your Money Count is a book for every person interested in a “holistic” view of money, possessions and the abundant life. Jim Munchbach has effectively zeroed in on the critical elements of living our financial lives wisely. I fully expect this book will change the way you think about money and I highly recommend it. “

— Dave Briggs, Director of the Stewardship Ministry at Willow Creek Community Church

“Jim has a way of communicating simple, practical truths so they change our lives. His compelling writing style and stories breathe life and hope into our efforts to manage money. I recommend this book to people of all ages who want to be more intentional about their finances . . . and their lives.”

—Linda Miller , Global Liaison for Coaching, The Ken Blanchard Companies !

“Jim should have titled the book Make Your Life Count because he goes beyond showing you how to manage your finances. He opens our eyes to see what is really important in life —how money and investments can help us reach our life’s goals.”

— Tom Wright, State Farm agent and author: Stop Selling And Start Marketing !

“More than any other book on the market, Make Your Money Count will help you align your money with your heart. With compelling stories and a practical “blueprint” Jim Munchbach will inspire and equip you to manage your finances with fresh vision and purpose.”

— Rick Baldwin, Sr. Pastor, Friendswood Community Church *

When you enroll in Make Your Money Count, you’ll get access to everything you need to create a compelling plan in 30 days – starting with Your *Blueprint for Financial Success*. Learn the skills you need to achieve more clarity, confidence, and contentment in your financial life.

Books Featuring The Blueprint

Whether you’re an independent investor or a Financial Advisor, The Blueprint for Financial Success is designed to help you manage the risk and opportunity of everyday life, recover from the unexpected, and realize your highest purpose.

Make Your Money Count

Featuring The Blueprint for Financial Success™, Make Your Money Count will help you connect your resources to What Matters Most.

What Matters Most for Financial Advisors

Trust is What Matters Most in any relationship. For any professional who makes their living selling financial advice, The Blueprint for Financial Success™ is a powerful tool. Learn more with a copy of What Matters Most by Jim Munchbach, Certified Financial Planner™.

Allied for Success

Creating a Synergy of Specialists to Fulfill Our Clients’ Dreams by Jim Munchbach, CFP® Professional. Published by FPA Press.

Trust Training for Financial Advisors

Join Us Today!

RePlan65.com: Financial Advisors Helping DIY Investors, Families, and Small Business Owners Make Your Money Count

🔹Save More Money

🔹Pay Lower Taxes

🔹Build a Better RetirementClick here to Enroll in the Missional Money Online Financial Planning Course.